Introduction

2022 was marked by high volatility across commodity markets, showing the importance of data-driven decision-making and risk management. With this background in mind, hEDGEpoint's Market Intelligence team has put together an outlook for agricultural and energy commodities in 2023, to help you navigate these dynamic markets with resources based on fundamental analysis.

In this report, we go from a broader macroeconomic analysis, with China's post-COVID return, global inflation, and high interest rates, to a more fundamentally based one, considering supply and demand dynamics for the main commodities.

The carbon market, for instance, is one hot topic, and its developments throughout 2023 are worth monitoring closely.

Looking at the energy market, it plays a fundamental role in the global inflation dynamic, combined with China's comeback and lower growth in the West.

Among agricultural commodities, grains face a new global trade situation due to the extension of the Russia-Ukraine conflict, as well as the back-and-forth of biofuel policies.

An expected surplus set the tone for the sugar market, while its driving forces range from fuel pricing issues in Brazil to Asia's decision regarding export quotas.

You, the reader, are invited to enjoy a cup of coffee while we take you on a journey across this market, paying attention to its ever-present volatility. In 2023, price variations will mostly depend on the transition from La Niña to El Niño.

We're here to offer risk management solutions in a world in transition. You can count on us!

Have a safe journey.

Market Intellignece Manager

hEDGEpoint Global Markets

Summary

- Thin liquidity and an economic slowdown in the West will be key themes to watch in 2023, as well as the rapid comeback by China - where liquidity has been rapidly rising and providing optimism to commodity markets. The perception of peak interest rates in developed nations, with commodities in tight supply, has created a positive outlook for most emerging currencies within the macroeconomic framework.

- Oil markets were very volatile in 2022, and 2023 is anticipated to be the same. Supply restrictions and worries about a potential slowdown in the West have made prices swing recently. China’s comeback, after strict COVID-containment measures, adds optimism to the demand side - especially since it could offset any demand weakness in the West throughout the year.

- Political aspects play a considerable role in any compliance market. For both Cbios and RINs, recent developments have impacted prices. Some relevant announcements should be made in 2023, adding volatility to these markets.

- The sugar market starts 2023 with a bearish bias, as a surplus is often associated with falling prices. However, there are some risks to this vision. Much can still change - whether in terms of macroeconomic developments, government decisions, or even weather anomalies.

- Bearish macro trends may affect coffee in the 1Q. Destinations are well supplied, and demand may lag early on, but growth is expected. Global economic recovery is bullish for commodities, enjoying support in the 3Q. If crop development is not affected by El Niño, the 23/24 and 24/25 crops may lead to some pressure in the 4Q.

- The Chinese reopening (which can be seen as almost as a certainty) and the macroeconomic scenario (still under debate) will be the leading demand drivers for cotton, with increases in imports potentially benefitting Brazil, while American producers may start to focus on other cultures.

- The main soybean producers showed an increase in area for 22/23. Still, for Argentina, the larger area may not translate into higher production. Biofuel policies can support oil consumption, but meal possibly won’t see the same growth.

- For corn, the scenario is tight, at least until 2H/23, due to crop failures (in the US and Ukraine) and potential losses in Argentina. Thus, there’s a lot of pressure on the Brazilian winter crop and incentives to increase the area of Northern Hemisphere crops.

- The impacts of the war in 2022 may linger through 2023 in the wheat market, leading to acreage changes, and a bigger role for Russia and the European Union, as they fill the gap left by Ukraine and Argentina in global markets, all the while forcing the main importers to adapt.

Markets

Macroeconomics

2022 was a historical year for those that follow monetary policies globally. Central banks around the world decided to collectively tighten monetary conditions to battle inflation, while rapidly raising interest rates to the highest levels in 40 years. Even though this strategy has partially worked, as CPI levels have come down in most nations, this has also created additional volatility in financial market assets.

This is because higher interest rates lead to lesser liquidity, with capital being directed to safer assets, like fixed income, in comparison to naturally more volatile ones - commodities and emerging currencies, to name some. Considering that developed central banks aren’t anticipated to cut interest rates so soon, it’s reasonable to expect this low-liquidity environment to last throughout 2023.

Constantly changing geopolitical factors have also exacerbated this trend, especially with the Ukraine invasion anticipated to not come to an end soon. The region most impacted by this conflict was Europe, which saw domestic energy prices dramatically rise.

Europe managed to offset the loss of Russian flows of piped gas by purchasing imported LNG, but at the cost of local inflation. Russian energy used to be among the cheapest in the world, which helped Europe consolidate the competitiveness of its industry in the past. Now that the region pays exorbitant prices for foreign products previously supplied by Moscow, we could see the case of manufacturing plants relocating from Europe to places where energy is cheaper.

This has already started happening with several companies in the fertilizer sector. BASF, for example, decided to permanently downsize its exposure to Europe, and increase its investments in Asia, as importing ammonia got cheaper than producing it domestically in Europe. This partial loss of competitiveness due to structurally high energy costs will be a factor to watch in Europe. It could bring additional weakness to the euro due to record low net trade balances seen across the region. Factors like these explain why Europe is set to be a region where growth will disappoint in 2023, with polls suggesting a contraction of -0.1% in its GDP.

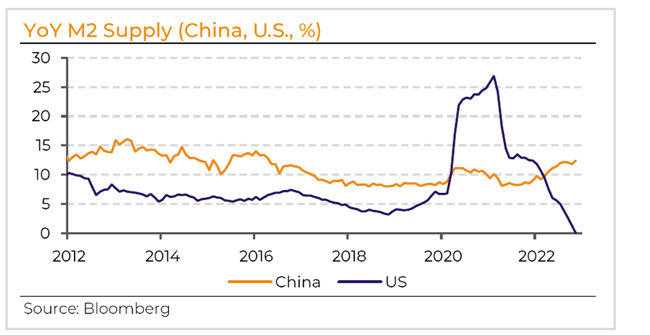

What’s interesting is that while the West goes through a liquidity crunch, with central banks likely maintaining elevated interest rates throughout the year, China’s money supply is seen rising at one of the fastest rates on record.

China’s economy is highly sensitive to the domestic availability of credit, so activity is set to rise further. The big question now remains on whether the Chinese comeback will be strong enough to offset the weakness in the West - both in Europe and the U.S. Thus far, this looks like a plausible possibility, as Western activity has remained incredibly resilient to the strongest interest rate shock of the past 40 years.

If that’s the case, then commodities that are typically associated with China could have a positive year in 2023: energy and metals, especially, as they have tight inventories at a moment when demand is seen rising because of the Chinese comeback.

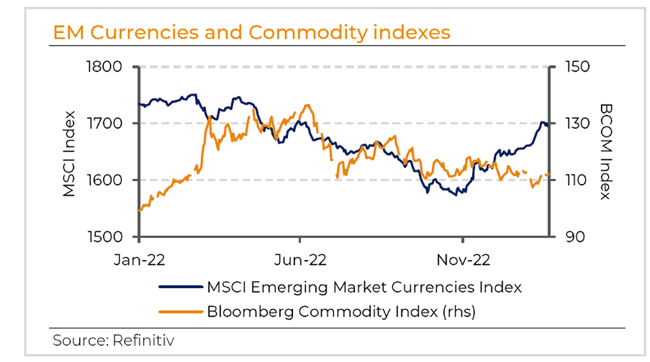

Emerging currencies (EMs) had a challenging year in 2022. Due to global inflation, financial conditions were tightened globally. This, alongside weak activity in China, led to poor performance by the EM currencies.

However, the situation seems to have changed this year. After falling 4.2% in 2022, the J.P. Morgan EM FX index in 2023 had its third best start of the year in the past twelve years. We believe emerging market currencies can continue to outperform for two reasons, even though the road ahead may be bumpy.

First, as inflation cools down in the U.S., the Fed is approaching the end of its current tightening cycle. As expectations over a more gradual pace of tightening kept rising, U.S. yields have fallen since last October. Consequently, their relative attractiveness compared to high-yield emerging countries declined.

This scenario will likely continue, even though U.S. yields may bounce back a little during the year. Even though inflation still has the potential to positively surprise in the U.S., which would lead to rising bond yields, EMs remain well positioned due to their elevated yields.

On top of that, China lifting its Zero-COVID policies allowed greater risk related to the sentiment that favors EMs. Pandemic-related measures started being lifted in late 2022, and while confirmed infections spiked dramatically, Chinese authorities have moved on, and aren’t planning to return with lockdowns.

This policy shift happened faster than anticipated, and combined with a looser monetary policy to breathe new life into China's economic growth prospects for this year. However, we need to remember that China may still face challenges in the short term. Its commodity imports remained down YoY, expansionary economic policies don’t seem as effective as before, and the real estate market remains in a complicated situation.

This policy shift happened faster than anticipated, and combined with a looser monetary policy to breathe new life into China's economic growth prospects for this year. However, we need to remember that China may still face challenges in the short term. Its commodity imports remained down YoY, expansionary economic policies don’t seem as effective as before, and the real estate market remains in a complicated situation.

Nonetheless, as soon as China’s commodity imports gather pace, the impact on prices can be significant. Given that commodities are vital for the trade balances of most emerging countries, a bullish scenario for commodities should maintain the EM currencies’ strength.

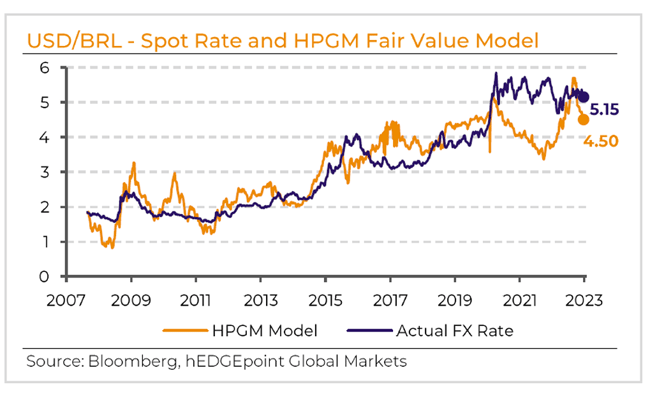

This scenario is favorable for the USD/BRL exchange rate, as Brazil still has high real and nominal interest rates, with relatively stable inflation. The main obstacle for the BRL’s strengthening can be market skepticism over the new administration’s fiscal policy - which could increase the fiscal risk and consequently weaken the Real.

One thing is clear, though. Macro fundamentals will have another very volatile year in 2023. China’s comeback, interest rates likely peaking in developed markets, and the threats of a global slowdown should all propel large price swings in various assets.

Energy

We had a remarkable year for the oil and gas market in 2022. Major supply shocks were seen as Russia decided to invade Ukraine, forcing traders to self-sanction Moscow while policymakers come up with measures aimed at reducing the country’s energy export profitability.

The initial uncertainty on how many barrels would be lost by these measures, coupled with already low Russian gas flows to Europe, left prices extremely volatile. Brent almost reached 130 US$/bbl in the beginning of 2022, but ended the year on a bearish tone, close to US$80/bbl.

The year of 2023 wasn’t initially expected to be so different if it wasn’t for one thing: a likely recession in the West. Strong backwardations seen throughout 2022 across the energy complex weakened, and quickly flipped into contango. Markets aren’t unanimously bullish anymore.

After high inflation levels, central banks decided to start hiking interest rates in the fastest and most synchronized way in 40 years. Global rate hikes of such a magnitude would never pass unnoticed, without causing any economic damage. And that’s exactly what’s happening. Industrial indicators have softened, making traders anticipate a smaller oil demand in the West during 2023. However, factors such as China's comeback may challenge this bearishness.

After more than 2 years under extremely severe COVID containment measures, China has decided to gradually reopen. The country that before lockdowns was the largest LNG importer had to scale back shipments as industrial activity pulled back. The same thing happened with oil.

After high inflation levels, central banks decided to start hiking interest rates in the fastest and most synchronized way in 40 years. Global rate hikes of such a magnitude would never pass unnoticed, without causing any economic damage. And that’s exactly what’s happening. Industrial indicators have softened, making traders anticipate a smaller oil demand in the West during 2023. However, factors such as China's comeback may challenge this bearishness.

After more than 2 years under extremely severe COVID containment measures, China has decided to gradually reopen. The country that before lockdowns was the largest LNG importer had to scale back shipments as industrial activity pulled back. The same thing happened with oil.

The biggest question now is if the Chinese reopening will be strong enough to offset a likely recession in the West - which, based on a historical comparison with the 2008 financial crisis, wiped out 2% of the global liquid’s demand, something close to two million barrels per day of oil and products.

Reaching a demand destruction of equivalent size may be relatively hard this time, especially considering that the anticipated slowdown in the West could be relatively mild. Employment numbers are extraordinarily strong, despite the interest rate shock. The same is happening with household consumption.

On the supply side, there are issues that shouldn’t be ignored. Capex spending is globally low, especially on the upstream front. Producers that could be investing to increase their supply volumes have decided to raise their dividend payments over Capex investment - limiting the supplies that could be eventually brought to the market. This is the case, for example, with American shale. Field spending has diminished, and the inventory of existing oil wells to be put to work to offset natural declines is at a multi-year low.

Not to mention that OPEC is also struggling to increase production volumes, either because of infrastructure-related issues, political unwillingness, or sanctions put on relevant members. These issues show not only why it’s been tough for them to meet their monthly production targets, but also that replacing Russian oil barrels in case of a sanction-led supply loss will be considerably hard.

This bullish view, led by the understanding that supplies in this market are tight, isn’t immune to downside risks. One of them is that the recession could be stronger than initially anticipated, which would make more supplies available. The other is that China could potentially increase its refined product exports to regions where inventories are tight - for example, Europe and Southeast Asia.

Beijing allowed its refineries to export almost 380K bpd (138M bbl total) of refined products in 2023, on top of already elevated allowances seen at the end of 2022. This means that Beijing is exporting fuel like it’s never done before. The greatest pullers of these barrels are likely to be Singapore and Europe - where inventories are extremely low, especially those of diesel. The problem is that, even though Chinese supplies are likely to increase, no one knows how Russian volumes will behave with the embargo on Russian diesel and other refined products that kicked off in February, 2023.

Another downside risk is related to the fact that the global refinery capacity shortage is substantially decreasing. Several projects have come online in the Middle East and Asia, offsetting refinery closures and biodiesel conversions seen in Europe and the U.S. Capacity in China is estimated to grow by 1.12M bpd by the end of 2023, which - alongside new Middle Eastern capacity becoming operational - could make Europe easily replace Russian diesel. Kuwait’s brand new, gigantic 615K bpd refinery has just started operating, and refined product exports to Europe have increased.

The perception of larger supplies also applies to the natural gas market. The crisis started in Europe by declining Russian exports has substantially improved. Russian piped gas was substituted by imported U.S. and Qatari LNG in the region, at the cost of local inflation.

These LNG flows were very useful for the region to replenish its natural gas stocks, which were extremely low with the decline in Russian flows after the invasion of Ukraine. Warmer temperatures for the winter, and hence lower demand for natural gas, have also loosened Europe's gas balance - which explains the rapid fall in gas prices. Lower LNG demand from China, due to lockdowns, has also left more product available globally.

The combination of these factors made the natural gas in Europe trade in contango (TTF), as inventories reached elevated levels, and a line of LNG tankers formed near ports.

The main question is how this market will look as soon as China gets back into global trade. When it does, will it leave enough product to Europe, or will European buyers have to bid Asian prices? The second option is more likely. A point of attention here is that the Freeport LNG plant, that represents 20% of American LNG export capacity, will become operational in 2023 - which means domestic U.S. natural gas balances could become tighter throughout the year.

Gas should be closely watched by the agricultural commodity market, as it’s the most important feedstock for nitrogen fertilizer output. Europe currently has up to 10% of market share in this market. Should gas prices further spike in 2023, output margins could come under pressure again, and diminish the local availability of these raw materials - like urea and ammonia.

One thing is clear: the energy market in 2023 will play a crucial in the global inflation dynamic. Especially if the Chinese comeback becomes stronger than initially anticipated, it will potentially offset the impacts of a likely recession in the West.

Carbon Markets

CBIO (Renovabio)

Renovabio has had a few changes in 2022. Some of them include the postponement of the deadline to prove compliance with the annual targets (Decree 11.141/2022), the reduction of the 2023 target (CNPE Resolution No. 13/2022), and the revision of the Cbios market structure (Ordinance No 56/2022).

The compliance deadline was originally set for December 31 of each year. For the 2022 target, this date was postponed to September 30, and for the following years, to March 31.

The new deadline to prove compliance has caused a visible impact on this market’s dynamics. It has caused a seasonality break for traded and retired volume when compared to 2021 values. Traded volume was below the yearly average during November and December, 2022. Usually, the months preceding the compliance deadline have above average trade.

With the new compliance date for the 2022 target on September 30, 2023, it’s also possible to see a change in the market pattern in the two months preceding this date. Distributors are more likely to buy and retire Cbios during this period, a bullish trend for Q3 in contrast to Q1 and Q2, when more Cbios should be available in the market.

According to ANP data, the amount of Cbios issued in 2022 totaled 31.4 M Cbios, 2% above 2021 emissions, and 13% below the 2022 target of 35.98 M. Adding the existing Cbios stocks to this number, there were 41.9 M Cbios available in 2022. The amount surpasses the 2022 target of 36M Cbios by 5.92 M.

For 2023, with the new revised target of 37.47 M Cbios (previously 42.35 M), distributors should find no difficulty in achieving the compliance target by March, 2024. Cbio stocks at the start of 2023 account for almost 16% of the year’s target.

Some interesting news to keep an eye on this year is the development of the Cbio futures market. The Ordinance No 56/2022 issued in December, 2022, by MME substitutes Ordinance No 419/2019 and creates a path for a futures market. More specifically, Article 7 of the document allows financial institutions negotiating directly with primary issuers and buyers to be identifiable in case of future Cbios transactions. This change is seen as a way to reduce price oscillation.

Risks

As in any compliance market, political aspects play a considerable role in the program’s future. Brazil’s newly elected government has been considerably highlighting an energy transition to renewable fuels, and the role public policies will play. The “Government Transition Final Report” shows concerns over the Renovabio Program’s target reduction, indicating a possible shift in the program’s path going forward.

Despite the new government’s rhetoric, some signals sent to the biofuel industry were perceived as misleading. The federal government has extended its federal tax exemption on fossil fuels, raising uncertainty among the biofuel sector. A possible intervention in fuel pricing methodology also brings concerns as it could artificially reduce the parity between biofuel and sugar, making a greater amount of raw material needed for the sweetener’s production.

Cbios are highly dependent on biofuel production, especially ethanol. In 2022, 85% of all Cbios issued came from ethanol production. Thus, any price interference of this sort, causing a reduction in ethanol production, would necessarily mean a reduction in Cbios issued.

RIN (Renewable Fuel Standard-RFS)

The EPA announced the proposed Renewable Volume Obligation (RVO), for the 2023-2025 period, on December 1, 2022. From 2023 onwards, the volumes are no longer set by Congress’s statutory targets, marking a new phase of the program.

The proposed volumes announced by the agency fixed blending targets for the next three years at 20.82 billion gallons in 2023, 21.87 in 2024, and 22.68 in 2025. For 2022, the mandate was set at 20.63 billion gallons, plus a supplement of 250 million gallons for volumes that were in previous years, totaling 20.88 billion gallons.

On a percentage basis, the 2022 RVO requires biofuels to account for 10.82% of transportation fuel. For 2023, 2024, and 2025, biofuel blend levels would rise to 11.92%, 12.55% and 13.05% respectively.

If, on the one hand, the possible volume for conventional biofuels was seen as relatively large, the target for biomass-based diesel fuels was perceived as disappointing on the other hand.

According to the proposed rule, conventional biofuels (such as corn ethanol) could represent up to 15 billion gallons of the RVO requirement in 2023, and 15.25 billion gallons in both 2024 and 2025. The amount would exceed the current blend wall, which is a 10% ethanol blend on gasoline or E10.

For biomass-based diesel, however, yearly growth in volume was limited at 2%. The proposed volumes were below market expectations, considering a predicted surge in demand and production capacity additions for 2023.

The impacts of the announcement could be felt both in the RINs market as well as the soybean oil market. Following the agency’s release, CBOT soybean oil future prices, which had experienced a year of strength, dropped as the mandate for biomass-based diesel fuel was perceived as relatively low. Consequently, this led to lower soybean oil demand. Most RIN prices also followed the descent, with an exception for RIN D-3, the cellulosic biofuel pathway with a minimum of 60% Greenhouse Gas (GHG) reduction.

In addition to the proposed RVO, a pathway for EV makers to generate credits was also announced by the EPA. The proposition is seen as a possible alternative in an attempt to reduce the country’s emissions in the transport sector. The so-called e-RIN would be generated for every 6.5 biofuel-powered kilowatt hours in an EV battery. The EPA estimates as many as 600 million credits will be generated by this pathway in 2024, and 1.2 billion by 2025. This scenario would be bearish for RINs, biofuels, and its feedstocks as it would increase the RIN supply.

Following the announcement, a public hearing was held on January 10-11, 2023, to collect the views and opinions of related market parties. American biofuel sector representatives have expressed their views on the proposed RFS through associations.

The biodiesel sector has argued that the proposed value overlooks the investments the industry has already made in additional capacity and estimates published in EIA’s short-term outlook. For instance, they argue that EPA data shows the U.S. market exceeded 3 billion gallons of biomass-based diesel in 2021 and 2022. Some statements also include the U.S. Energy Information Administration’s Short-Term Energy Outlook data, which projects a 500-million-gallon increase in biodiesel and renewable diesel consumption for 2023. The EPA’s proposed volumes for the biomass-based diesel category will reach 2.95 billion gallons by 2025.

Some associations have criticized the EPA’s proposed growth rate, demanding stronger blending requirements. Others want the agency to finalize blending as proposed.

Refiners also participated in the public hearing. Their wish is for the EPA to lock in lower volumes, pointing to estimates from the Energy Information Administration showing ethanol demand as lower than the EPA’s blending requirement. Additionally, they mentioned the rising cost of compliance, as the RVO cost rose in 2022 above previous years’ levels. Biofuel sector representatives, however, suggested that this cost can be passed on to final consumers.

A public comment period on the proposed rule remains open through February 10. The administration should present final RVO volumes by June 14, 2023. Price volatility is expected until a final decision is reached by the EPA.

Sugar

Macroeconomics

While the market's risk sentiment took a downturn at the beginning of January, 2023, as both the E.U.'s and U.S.'s economic perspectives improved, we still expect the first quarter to present some challenges regarding inflation and COVID's remnants.

China's gradual reopening and economic acceleration from the 2Q onward might offer some support to commodity prices, especially given the expected enhancement of oil demand. Besides, the improvement in the U.S. Consumer Price Index (CPI), and other key regions' continuous downside momentum in inflation could limit the need for further interest rate hikes, and thus, commodity bearishness. Therefore, the macro environment is expected to become supportive, adding a bullish note to a fundamentally bearish market. Unlike the past three crops, 22/23 sugar (Oct.-Sep.) is expected to be a surplus year.

Fund Positioning

The last time the sugar balance showed a small surplus (2018) or even a slight deficit (2019), funds went short. What could be stopping them from switching their positions on the verge of a 3.5 Mt surplus?

The bearish note found some resistance in the short-term tightness and macro improvements by the end of 2022. As the Northern Hemisphere crops started nearly a month late, namely in India, Thailand, and Central America, supplies faced lingering shortness. This physical trend, added to a supported energy complex, and inflation showing its first signs of subduing, helped funds to bet on the higher end and hold their long positioning. News regarding poorer-than-expected yield results from Q1’s main supplier, India, is also bound to put the market on a more cautious mood.

In this sense, speculators might hold their positions until something big happens. It’s essential, therefore, to keep an eye on some key fundamentals: the weather in Brazil, and the crushing rhythm and yields in the Northern Hemisphere.

If nothing goes sideways during this period, the lurching of the new Brazilian crop can do the trick, offering some correction to the current price level. From Q3 onwards, the physical market is expected to receive the first tranche of the country’s new production, feeding the first signs of over-supply.

Fundamentals

Marked by supply tightness, the 21/22 (Oct.-Sep.) crop felt the direct effect of a major Brazilian crop failure. With some improvements in the Center-South’s 22/23 (Apr.-Mar.) season and excellent expectations regarding 23/24 (Apr.-Mar.), the fundamentals drive towards bearishness. However, we should be cautious. Although we’re entering a surplus year, outside the sweetener market, commodities face a favorable environment, which could add a cap to the downturn in prices.

A surplus in the S&D also implies comfort in trade flows. Coming from a tight year, especially in the white market, the first two quarters are expected to be slightly less comfortable. Although India and Thailand’s crops are moving at a good pace, lateness and possibly lower yields worry the market. Combined with a positive perspective regarding global consumption growth, which should reach 1.23% in 22/23, this reduced surplus might still offer some support to prices. However, as India and Thailand move back to their usual production quality breakdown, white might exceed raw in quantity during Q1, pressuring the white premium.

However, as Brazilian Center-South production expectations unfold and show positive prospects, Q3 and Q4 are bound to have a higher exceeding volume, with increases in the availability of raw. This view gives the bearish bias of raw some strength, especially considering the Brazilian government's signs of a possible intervention in fuel pricing methodology. Depending on its outcome, bringing parity down artificially in the domestic market would lead to a max sugar crop and a lower price floor - closer to Chinese import arbitrage. Combined with the Northern Hemisphere intercrop, the white premium can find support from April onwards.

Asia

The main suppliers during the Brazilian intercrop are India and Thailand. Both started their 22/23 season later than expected.

India, for instance, has shown a great crushing pace, producing 12Mt of sugar until December, 2022, compared to 11.6Mt the previous year - a 4% improvement. However, when it comes to total production, the country has faced some adverse weather - excessive rainfall and cloudier weather might have affected the cane’s vegetative development. Thus, we don’t expect production to reach last year’s 36Mt record, especially considering a higher ethanol diversion. However, there’s an upside risk, as actual yields only become clear around March. Hence, our preliminary sugar production expectation is 35.5Mt. For exports, we believe in a 6 to 7Mt range - depending on the production upside, as stocks are already pressured with 6Mt of exports and 35.5Mt of production. In the end, the announcement of a further 1Mt export quota is seen as difficult.

Thailand has also shown a positive rhythm. By December’s end, the country produced 1.8Mt of the sweetener, 11.7% higher compared to last year - even with a late start. While we do believe in a production recovery to around 11.5Mt, we should be weary of yields - its growth can be restrained by the lower use of fertilizers, higher cost (green cane opposed to burnt), and the ban on some agricultural chemicals.

Europe

The European market has been highly affected by the Russia-Ukraine conflict, in terms of cost, at the same time that it suffered from adverse weather. Thus, both E.U. and U.K. production are expected to be lower YoY. A warmer and drier than normal summer and a colder winter were extremely damaging to yield. We expect a 7% drop in yield, in line with the MARS agency’s 2% decline from the 5-year average. This means a drop in E.U. 27 + U.K. production to 14.7Mt (already considering ethanol diversion), adding support to their import needs, while reducing export availability.

North America

Both the U.S. and Mexico are expected to produce slightly less than in 21/22. Affected by adverse weather, U.S. beet production has seen a downturn. However, part of it will be offset by improvements in cane results. Rains in the country's southern region contributed to higher cane yield expectations, keeping the sugar production close to 21/22 levels, while dropping only 1%.

Mexico’s area is expected to be 4% higher. However, yield reductions should offset its positive implications. The latter was affected mainly by a drier-than-average weather during the cane’s vegetative development. A 6.3% drop is expected, according to Conadesuca, which implies a cut of 2.7% in sweetener production.

Central America

Guatemala and El Salvador started their crop later than usual. The former has faced some issues during the cane development stage, and thus, we revised our numbers accordingly to about 2.7Mt - a 2.4% reduction. The lower pace seen so far has added to the short-term tightness. Compared to 21/22, until December, sugar production fell short by 5%.

The same pattern can be seen in El Salvador. Production is lagging nearly 30%. However, the weather seems favorable for crushing, and we expect its rhythm to pick up. Overall, no major adversity was reported during cane development, and therefore, prospects remain quite positive. We expect a 2.3% increase YoY in sugar production, reaching approximately 825kt.

Brazil

The Center-South is the main sugar supplier during the Northern Hemisphere’s intercrop. During the past two crops, it faced both a break in 21/22 (Apr.-Mar.), and an initial recovery (22/23). The crushing of the latter is expected to finish between 550-555Mt. We remain slightly conservative and thus closer to the lower end (549.3Mt). As prices were mostly favorable for sugar production, mix expectations are quite sugary at 45.7%. It’s important to note, however, that a 33.7Mt sugar production was already priced in. Now the market turns its eye to 23/24 (Apr.-Mar.) prospects.

Weather has been positive overall, with many regions showing good improvement in vegetative development. Rains are predicted to continue at a good pace until the new crop starts, adding positiveness to its crushing volume. If this behavior persists, crushing could reach close to 600Mt. Preliminary data allows us to estimate a total cane availability of 595Mt, with a positive bias. However, if weather surprises, with an extension of the precipitation period and excessive cloudiness, there could be a downturn. If not as intense as in 2021, inadequate weather would make crushing vary between 580 and 600Mt. This means that sugar production has a possible range of 35.5 to 36.7Mt

Currently, we remain positive and close to 36.7Mt. Of course, this high volume doesn’t rely entirely on feedstock only, but also results in a bearish view of the domestic fuel market - pushing gasoline and ethanol parity down, and thus, making it harder for the biofuel to compete with the sweetener.

The Brazilian government has extended federal tax exemptions, raising many red flags about what the ethanol sector can expect for 2023. Nothing has been decided regarding gasoline being an essential good or not, and thus, it’s still open to discussion. Additionally, Petrobras’s pricing formula could face some changes this year, and history says that it could be done so that prices are brought down artificially - the worst-case scenario for the ethanol sector. In this sense, much must be decided. So far, the sector continues to bet on another year of max sugar, and smaller hydrous participation in terms of fuel demand.

Risks

Apart from the weather, for which any deviation from what has been discussed could result in different production volumes, and thus, on balance, our sugar view faces other risks.

While the current market configuration suggests that we’re entering a bearish year, prices might find some support in both the energy complex and favorable economic conjecture. Besides, during the Brazilian intercrop, the market usually finds its floor based on the Indian export parity, currently estimated at 18.7USc/lb.

However, as we approach the start of the Center-South 23/24 crop, we might face a steeper price correction depending on the Brazilian government’s decisions regarding fuel prices and taxes. Assuming there are no changes in Petrobras’s pricing methodology - which is unlikely - we could see the floor reaching 17.5USc/lb, if all federal taxes are brought back up. If gasoline’s “essentiality” is revoked, and state taxes are brought back to May-2022 levels, we can see this floor rising to 18.2USc/lb. This is the most bullish scenario and even more unlikely. There was no final decision made, and government statements point to a broad bearishness and an unknown floor.

The biggest bearish risk relies on Petrobras’s pricing methodology definition. If the government decides to bring down domestic prices artificially, as it did before 2017, the ethanol sector will take the hit, and the mix will ultimately be sugary.

Having no defined floor for ethanol, a second kind of support for sugar prices can be found in China’s import parity. Currently, we estimate it being around an average of 17.2USc/lb, considering Brazil and Thailand as the main origins. Therefore, sugar has a limited range for correction, as the Asian giant would probably drain the market if prices dropped below this level, making hydrous production even harder.

Coffee

Macroeconomics

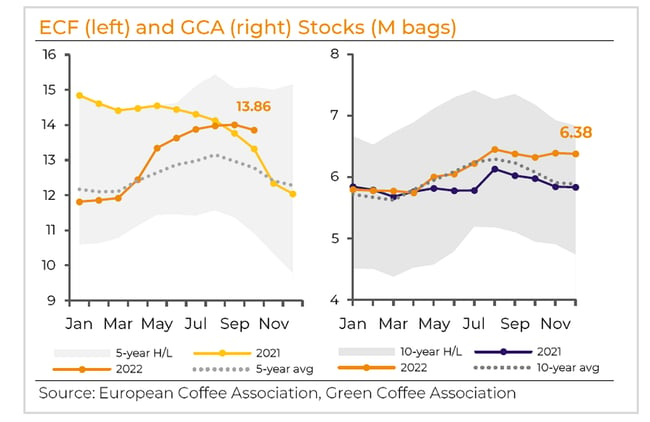

For 2023/1Q, we expect the global economy to continue to lag, as the discomfort brought on by inflation still lingers, although there’s much needed improvement when compared to 2022. The E.U.’s economic perspective has also recently been amended from recession fears. The second quarter, however, appears to be more optimistic. While the immediate impact from China’s new stance on COVID is still uncertain, the situation is expected to improve in the 2Q, as China returns in full to picking up commodities, and economic activity starts to return to normal in developed economies. As inflation subsides, central banks will review their hawkish stances, and credit costs will also decrease. These elements are also supportive for coffee prices. Some downward risk factors lie in the Brazilian currency, as the fiscal landscape is still undefined, and political turmoil also leads to uncertainty. Even so, the remaining fundamentals for the USD/BRL are solid. As it is, the currency outlook provides a bullish perspective for coffee.

Fund Positioning

2023 began with the coffee short spec position in line with the historical average (40K lots, now at 60K), but notably the highest level since the start of the COVID-19 pandemic. 23/24 cycle production doesn’t have the potential to create the same amount of short interest as 18/19 did (with record crops at the time), but potential from 24/25 in Brazil can trigger some additions to the short side.

2023 began with the coffee short spec position in line with the historical average (40K lots, now at 60K), but notably the highest level since the start of the COVID-19 pandemic. 23/24 cycle production doesn’t have the potential to create the same amount of short interest as 18/19 did (with record crops at the time), but potential from 24/25 in Brazil can trigger some additions to the short side.

The commercial long side has been in a downtrend since 2018, starting 2023 in line with the historical average (80K lots). Destinations are well supplied for now, with no immediate buying pressure. The commercial short side has been consistently decreasing since late 2021 and is now slightly below average (100K vs. 130K avg), a consequence of hand-to-mouth sales throughout the year, especially in milds’ producing countries - a situation that can continue into 2023, given lower output and a cautious stance from farmers.

Production

Currently, we estimate global production in the 22/23 cycle at 172.8M bags, with the low range of estimates at 170.6M bags. The possible adjustments to the production side in this cycle depend on the confirmation of lower crops in Colombia, Vietnam, and Central America - the production issues are already partially seen in export figures from the aforementioned countries, although the harvest is not yet complete. There’s a point of price support coming from the production outlook in the first quarter - as the harvest in these regions comes to an end, and the total impact is better assessed.

For 23/24, the focus is currently on Brazil. We estimate arabica output at 45.4M bags, and robusta output at 21.5M bags, for a total of 66.9M bags, although the low end of our estimates is currently at 65M bags. Initially, the abundant flowering and substantial improvement in rainfall levels created the expectation of a record crop with some agents. However, the damage from frosts and lingering water stress issues during vegetative development would have previously limited that possibility. The recovery in rainfall levels may lead to higher yields - larger cherries - although we estimate that total production will be limited to the 65-67M bag range. So far, the improvement in the Brazilian outlook outweighs the potentially lower milds’ crops, and from this, our view in the first quarter is neutral to bearish.

In terms of how the supply and demand balance may still fluctuate in 2023, the chart below shows our current base-case scenario, as well as the low- and high-range. For 22/23, the low-range scenario consists of unchanged demand vis-a-vis our base-case, but we consider the lowest production threshold for the Centrals, Colombia, and Vietnam - the countries that are currently prone to downward adjustments in output due to exports levels. For the high-range, we consider no growth in demand, and unchanged production vs. the base-case, and even in the most pessimistic scenario, 22/23 still leads to a deficit.

In terms of how the supply and demand balance may still fluctuate in 2023, the chart below shows our current base-case scenario, as well as the low- and high-range. For 22/23, the low-range scenario consists of unchanged demand vis-a-vis our base-case, but we consider the lowest production threshold for the Centrals, Colombia, and Vietnam - the countries that are currently prone to downward adjustments in output due to exports levels. For the high-range, we consider no growth in demand, and unchanged production vs. the base-case, and even in the most pessimistic scenario, 22/23 still leads to a deficit.

For 23/24, in the low-range, we also considered unchanged demand vs. the base-case, and for production, we consider our lowest estimate for Brazil (65M bags) and only a 2% growth in production for the rest of the world. Usually, following a year of crop failure, production grows on average by 5-6%. In the high-range, we considered unchanged production when compared to the base-case, with historically average growth in demand (+2%). Currently, we expect 3.2% growth in demand in the 23/24 cycle - a recovery after the 0.4% growth in 22/23. Given the uncertainty that’s inherent in long-term estimates, the 23/24 balance, that is currently at a 3.7M bag surplus, can still fluctuate in the -1.2M and 5.7M bag range.

When it comes to the last quarter of the year, however, our stance changes from neutral to bearish in terms of production, due to two factors. First, we have the beginning of the 23/24 harvest in most coffee-producing countries, and provided that weather issues don’t disrupt growth once again, the recovery could place the global balance into a surplus, following two years of deficit. Second, the 24/25 crop will start to develop in Brazil. This crop will be marked by a larger share of areas fully returning to production, as well as areas that were newly planted following the frosts. Additionally, robusta areas that suffered some production stress in 23/24 will also be able to recover. Consequently, there’s more potential for a record crop.

Demand

Destination stocks are seasonally elevated, and from CFTC reports (as explored above), there’s no immediate rush to buy. We expect demand to grow, but not at its full potential, with an addition of 0.4% in 22/23, as global economic activity still hinders a full expansion of consumption.

Thus, our view for demand is neutral to bearish in the first two quarters. The situation may improve once global economy returns to normalcy, with lower inflation rates and financing costs - and our view changes to bullish in terms of demand in the last quarter of the year, now already into the 23/24 cycle, with a 3.2% growth potential.

Weather

El Niño is likely to become active starting in the second quarter, leaving the current La Niña status behind. Any anomaly in weather is potentially bullish. In terms of El Niño itself, the phenomenon leads to warm and dry weather for the Centrals during flowering/cherry growth, which could hinder development. It could also lead to warmer and drier weather during the development of the 24/25 crop in Brazil. Still, the phenomenon also leads to warmer temperatures during the Brazilian winter, which lowers the possibility of frosts. In Southeast Asia, El Niño could also negatively impact Indonesian production, since it leads to drier-than-average conditions during cherry growth, and subsequent warmer weather.

Cotton

Macroeconomic perspectives and China’s COVID policy are poised to be the main market drivers for 2023, just as in the last few years.

After eight consecutive cuts in Asian demand in the WASDE, lesser demand for textiles is to be expected, as the main spinning nations are pressured by thin margins.

Even though there are signs of improvement in some economic indicators, impacts on cotton demand may still take a while, as there’s a lag between changes in the consumer end of textiles and actual cotton imports by manufacturers.

The Chinese reopening, on the other hand, can be seen more as a certainty, adding bullishness in that part of the global chain.

The problems faced by the Chinese in exporting their own cotton to the American market (due to alleged human rights abuses in the Chinese province of Xinjiang) are other sources of bullishness coming from East Asia, something that could be especially beneficial to Brazil.

Even though the crop begins with the planting late and low prices for producers in Mato Grosso, the leading producing state, current climate perspectives are good, with adequate levels of moisture.

As such, estimates from both Conab and the USDA point to high levels of production, which should in turn lead to strong exports.

Regarding the U.S., prospects are more worrisome: the last crop didn’t perform well, and the current scenario of weaker prices pushes farmers to other crops as they search for more profitability.

Soybean

The soybean market in 2022 was a story of high production expectations that didn’t materialize. Already at the beginning of the year, Brazil faced a crop failure while Argentina had an output below its potential, factors that set the tone for the year

When the U.S.’s 22/23 crop started, given Brazil’s lack of beans, and the favorable SX/CZ ratio throughout most of Q1, farmers leaned towards soybeans instead of corn. Still, dryness during key periods capped yields, turning what was supposed to be a record crop into a regular one.

Meanwhile, China has been consolidating its hog inventories at high levels, although recently the government has given signs that it’s not comfortable with the excess of supply. Still, feed consumption has been somewhat elevated.

Thus, even with the low production in Brazil, China still bought large volumes from the country (given the availability) and did the same when the U.S. started to harvest, only slowing down once Brazil’s 22/23 crop really started to be confirmed as a record.

Thus, even with the low production in Brazil, China still bought large volumes from the country (given the availability) and did the same when the U.S. started to harvest, only slowing down once Brazil’s 22/23 crop really started to be confirmed as a record.

Now, for 22/23 in South America, all the scarcity last year, plus the high fertilizer prices (that favor soybeans over corn) weighed on South American farmers’ decisions, pushing them to allot greater acreage to beans. In Brazil, that translated into a crop that is expected to be 20M ton larger than last year’s, and 10M ton above the previous record. Argentina also grew in acreage, although still was within the limits of past crops.

However, the roles have been reversed this year. While in 21/22, Argentina was able to maintain a relatively normal yield while Brazil suffered major losses, this time Argentina’s crop is in much worse shape. Still, it’s true that 22/23 total production is very likely to be a record thanks to Brazil (which we estimate at 150M ton vs. USDA 153M ton), helped by a better output in Paraguay.

At this point, USDA numbers point to a somewhat comfortable global surplus. However, we believe a couple of trims in Argentine and Brazilian production could still come, which would put us much closer to net zero, a slightly bullish case.

Additionally, we cannot help but notice that demand growth has been somewhat capped by supply levels over the last three crops, so consumption has some catching up to do.

Speaking of demand, it’s important not to forget about the byproducts. The oil portion of the soy crush has gone through a lot over the last year, and should continue to see high volatility. The fate of the soy oil market has been tied to a combination of government decisions on biofuel policies, rising inflation, and frequent changes in Indonesian and Malaysian palm oil export/biodiesel policies.

In the U.S. and Brazil, incumbent administrations should, at least in theory, lean towards greener policies. In the U.S., mandates have indeed been increasing since 2021. However, the sector argues that this growth is below their potential.

In Brazil, on the other hand, inflation has been playing a role in diminishing political will towards increasing biodiesel mandates, in two opposing administrations.

For 2023, the government is expected to increase the blend due to the large expected supply of soybeans. However, there are no concrete statements about the mandate after March/23, and if China buys as much as expected, competition for this "record supply" may prove to be high.

Even with some doubts, the consumption of soybean oil, at least in these two countries (the U.S. and BR), is expected to outgrow that of meal. This could create a surplus of the latter that would be pushed into the international market.

Even with some doubts, the consumption of soybean oil, at least in these two countries (the U.S. and BR), is expected to outgrow that of meal. This could create a surplus of the latter that would be pushed into the international market.

On one side, one might argue that the poor Argentinean crop might offset the “oversupply” of meal in Brazil and the U.S., and that’s true. On the other, looking at the complex as a whole, a crop failure in Argentina is equally bullish for both meal and oil. As such, there will be more demand for soy oil as well.

This imbalance could push the oil share even higher than it currently is, leaving markets even more subject to biofuel policies in the aforementioned countries, and to the Indonesian government’s will, which currently seems rather protectionist.

Corn

On corn, three facts from last year call for attention and will have an impact on this year’s dynamic: Ukraine’s faltering production, the crop failure in the European Union (E.U.), and the downturn in U.S. production.

Starting with Ukraine, the 22/23 crop began with good prospects. A lower production was already expected due to the war, but favorable weather until September fueled expectations that the conflict’s impact would be less intense.

However, an abnormally wet October and November prevented farmers from entering the fields on time, delaying the harvest of all summer crops, including corn. Additional limitations imposed by the conflict - such as insufficient manpower, high fuel costs, transportation problems, and access to storage facilities - further slowed the corn harvest. With that, Ukraine likely had a reduction of 1.5M ha (-27%) and 15.1M mt (-36%) in its harvested area and production, respectively.

Certainly, the impact of this lower output on global trade flows was overshadowed by the corn stocked from the previous crop that was being exported since July under the grain corridor deal. Still, it will continue to be a bullish factor for corn prices throughout 2023, as Ukraine will have a lower exporting capability during the year.

Additionally, as long as we don’t see a conflict resolution until April - when Ukrainian farmers start to plant their corn - a production recovery is very unlikely, as farmers may reduce their use of inputs (like fertilizers) to reduce risks and costs, and some areas may not be ready for planting due to late harvesting.

The scenario in the E.U. also helped the bulls in 2022. Some of the continent’s main producers faced severe droughts and heat waves during the 22/23 crop development, leading to the smallest yields and total crop since 07/08.

With a lower internal supply, E.U. corn imports surged in the current marketing year, making Brazil the most favored market, given Ukraine’s issues. That scenario will likely remain in place until Europe starts harvesting its 23/24 crop, which will likely recover from this year’s failure, should the weather remain stable as forecasts are indicating.

When it comes to the U.S., the price rally caused by the start of the conflict in Ukraine came a bit too late for most farmers to switch to corn, as soybeans were more attractive before the event. On top of a relatively small acreage, weather also didn’t help, hurting yields and increasing the number of lost acres. With poor production in the U.S., increasing ethanol mandates and not that much less feed demand, exports from the country are expected to fall. The pace of sales so far supports this argument.

Combining what has been said so far, Northern Hemisphere suppliers have had a low production, and the balance is tight.

The next in line to harvest is Argentina. However, high fertilizer prices have pushed farmers off the grain in favor of soybeans, and the “early corn” in the country has been facing much of the same weather conditions that are dragging soy production lower. Thus, at the very least, we shouldn’t count on a bumper crop from Argentina. We could see a pretty poor one if the “late corn” also doesn’t perform. We currently estimate 48M ton of production, versus the USDA's 52M and 49.5M last year.

Summing it all up, there’s a lot in line for the Brazilian crop to go well. Planted acreage is set to grow (by a lot), but with the soybean harvest still at its early stages in mid-January, the planting pace in Feb.-Mar., and the weather from March-June will be key variables.

A key shift - if not in supply and demand, at least in trade flow - will come from China. Despite a growing domestic deficit (production minus consumption), the country is expected to import 18M ton of corn in the 22/23 cycle. Although still a massive volume, it’s 5M ton less than in 21/22.

However, due to the issues with its main suppliers (the U.S. and Ukraine), China has included Brazil in its list of exporters. That could shift around 4-6M ton of corn from China’s traditional origins.

Finally, for the second half of 2023, we could expect Northern Hemisphere regions - namely the U.S., E.U., and Ukraine - to increase corn acreage, given the tightness that they’re currently facing. Of course, in Ukraine, that will strongly depend on the state of the conflict at that point. We’re still expecting them not to go back to pre-war levels.

Wheat

Of all fundamentals that had an impact on wheat in 2022, the Russian Invasion of Ukraine was undoubtedly the most important. Even though other fundamentals seem to be the main market drivers now, with futures prices in the CBOT even returning to pre-war levels, we expect the conflict to remain at center stage for 2023.

For starters, there’s strong evidence that Russia and Ukraine have plenty of reason to continue fighting, as Moscow has already annexed parts of Ukraine that Kyiv wants to see fully restored to its authority.

As such, using a prolonged conflict as a guideline, we can expect Russia to keep disrupting Black Sea flows, frustrating Ukraine’s attempts at increasing its exports to the needed levels.

Continued fighting would only add to the current strain facing Ukrainian farmers, as they’re already dealing with storage difficulties (due mostly to Russian attacks), and could see themselves at Moscow’s mercy again by the time the deal reaches its renewal negotiations in March.

For some, the solution is changing crops, with grains like wheat and corn losing ground to oilseeds (namely soybean, sunflower, and rapeseed).

Alongside the expected loss of area and productivity, producers are also struggling with prices and availability of fertilizers and fuel. Additionally, the acreage change should mean Ukraine will have a lesser role in global grains markets in the extended future.

Given the importance the country had before the conflict, the war could prove to be a prolonged source of bullish pressures for markets, forcing adaptations of both importers and exporters.

However, Russia likely had a record wheat crop in 22/23, which can offset the lower production in Ukraine - if more optimistic estimates are confirmed. Russian wheat exports were seen at 5-year highs in the last few months of 2022, a trend that ought to continue throughout 2023, as the country is perhaps the most benefited from the lack of Ukrainian wheat in the global trade flow.

Additionally, the outlook for the 23/24 crop is good so far, but the output will likely be smaller. According to the Russian agriculture ministry, the production target for wheat next year is 80-85 million mt, as the country is planning to lower the area planted with wheat in 2023/24 to stabilize the domestic market and prices.

So far, weather has been beneficial overall for winter crops across Russia. Long-term weather forecasts predict good conditions in general for winter crops, with extreme cold limited only to far eastern regions. Additionally, present snow cover across most of Russia and upcoming snowfall in southern regions should offset any adverse impact on crops.

For E.U. wheat, 2022 was also a challenging year given the drought and high temperatures witnessed in June and July - even though the impact was less severe than the one seen in corn, with only a 3.9M mt (-3%) reduction YoY. However, given Ukraine’s absence in the market, E.U. exports are moving at a good pace, above last year’s figures so far.

Looking at the 23/24 crop, a bigger planted area and good growing conditions have put the E.U. on track for a bigger harvest than last year. Nonetheless, unusually warm weather in Europe has stirred grain crops from winter dormancy, creating concerns that a subsequent plunge in temperatures could damage fields that have generally been in good condition.

Another wheat exporter that should benefit from this situation is Argentina, as exports of agricultural commodities are one of the main sources of much-needed foreign currency.

With that in mind, while worrying the government could place further pricing and export restrictions in another effort to curb inflation, producers may again prefer to plant barley instead of wheat.

Given that planting barley is better if soybeans are to follow, wheat could lose acreage, even if prices remain on the higher end of the spectrum.

That’s because soybeans were the target of the very successful “Soybean - Dollar” policy, which offered better exchange rates for exporters to bolster the Argentinian Central Bank’s foreign reserves.

The stronger dollar (alongside domestic macroeconomic difficulties) is also causing problems for some of the main wheat importers, forcing some to seek help from institutions like the IMF and the World Bank in order to make ends meet.

Grants from these institutions were already behind some import tenders in 2022, and we can expect them to remain relevant throughout 2023.

Even though these programs aren't anticipated to impact balances so soon, their performance is definitely something to watch.

Regarding the U.S., there are challenges ahead for the current crop, with worsening conditions being reported in Kansas, the leading producing state.

Meanwhile, global market conditions seem to be very interesting to producers in the long run, as the winter wheat acreage is expected to increase 11% over 2022, with a highlight in Texas, where acreage is expected to increase 26%.

In summary, Russia and the E.U. should keep filling the gap left by Argentina and Ukraine in the global market if the weather remains favorable. But we still have to keep an eye on relevant changes in conditions - especially in the E.U.’s case.

hEDGEpoint Market Intelligence

Written by:

Alef Dias

alef.dias@hedgepointglobal.com

David Silbiger

david.silbiger@hedgepointglobal.com

Heitor Paiva

heitor.paiva@hedgepointglobal.com

Lívea Coda

livea.coda@hedgepointglobal.com

Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

Thaís Italiani

thais.italiani@hedgepointglobal.com

Yuri Renni

yuri.renni@hedgepointglobal.com

LEGAL NOTICE

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes.

This document does not constitute any form of offer, or solicitation of an offer, sale or purchase in relation to any securities or investment products. Furthermore, this document does not create or is intended to create any commitment or obligation for HPGM to enter into any financial transaction with third parties.

The document was prepared on the basis of the sources indicated, and does not constitute advice of any kind, including but not limited to investment, tax, legal or accounting advice.

HPGM takes all necessary steps to ensure that the information used in this document is sufficient and from reliable sources, including third party sources. However, HPGM does not perform audit services and cannot, in all cases, independently verify or confirm the information received.

The information published in this document may change, and there is no guarantee as to the accuracy of the content, adequacy or completeness of the information contained herein. Certain economic and market information shown was obtained or provided by third parties or published sources and may not have been updated to date.

The information contained in this document is the exclusive property of HPGM, reproduction or redistribution in any electronic format or otherwise, without the express approval of HPGM, is prohibited.

HPGM and any person or company associated with HPGM will not be held liable for damages of any nature that result in direct or indirect loss or damage caused by third-party analysis of this document, and they are solely responsible for their actions. HPGM associates expressly disclaim any liability for damages arising from this document, including but not limited to: (i) reliance on any information contained in this document; (ii) any error, omission or impression in such information; and/or (iii) any action resulting from such information.

“hEDGEpoint” and the “hEDGEpoint” logo are trademarks, for the exclusive use of this company and its affiliates. Use or reproduction is prohibited, unless expressly authorized by HPGM.

Furthermore, the use of any other trademarks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HPGM in these marks or imply endorsement, association or seal by the owners of these trademarks with HPGM or its affiliates. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (only for customers in Brazil)..